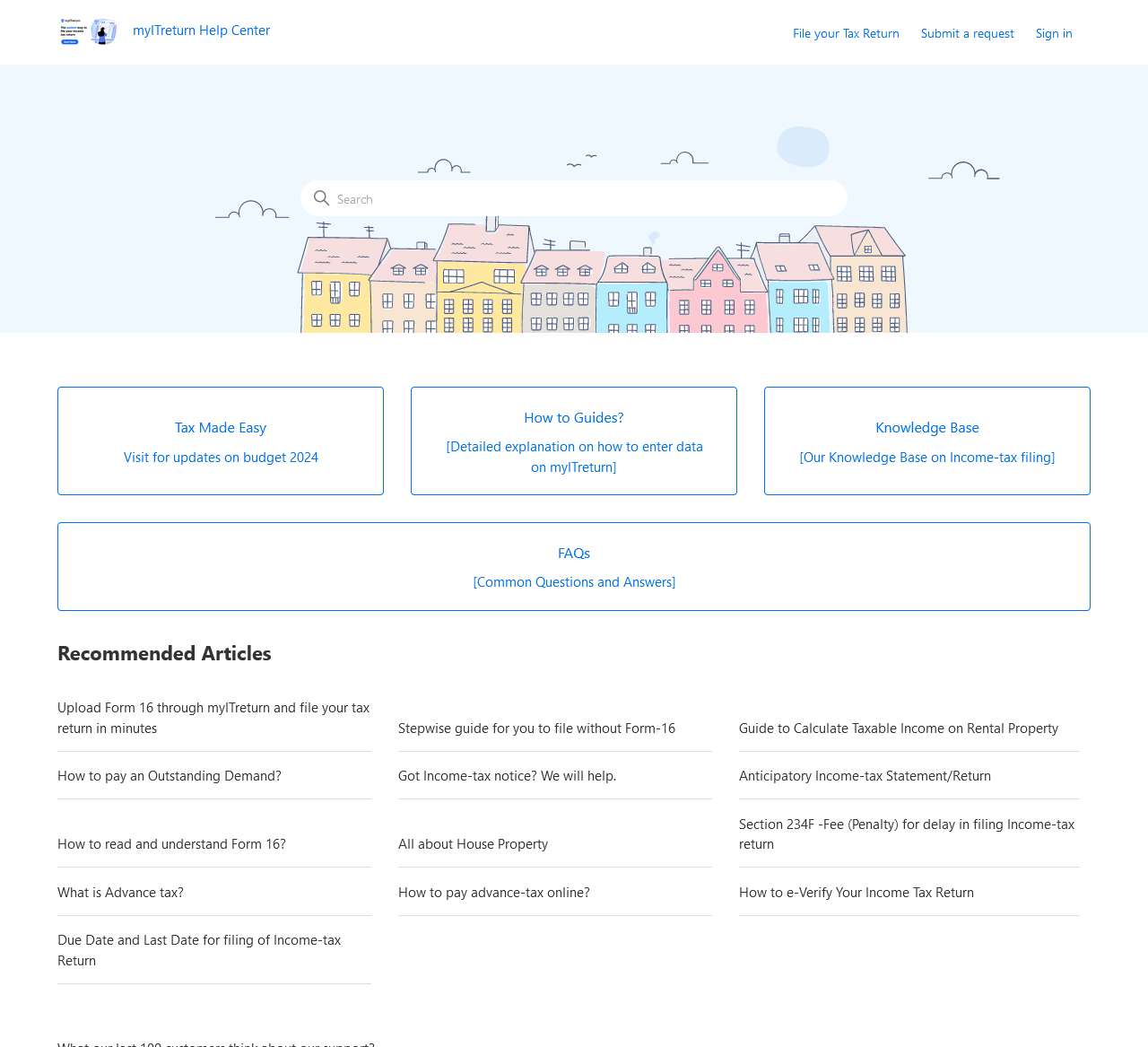

- File your Tax Return

- Submit a request

- Sign in

- Tax Made Easy

- Vitake a seat for updates on Budget 2024

- How to Guides

- Getledge Base on Income-tax filing

- FAQs

- Upload Form 16 through myITcome back

- Stepwise touch on for filing without Form-16

- Guide to Calculate Taxable Income on Rental Property

- How to foot the bill an Outbe on my feeting Demand

- Give a hancut a rug for Income-tax notices

- Anticipatory Income-tax Statement/Return

- How to catch up on reading and I get it Form 16

- All about House Property

- Section 234F – Fee (Penalty) for postpone in filing Income-tax come back

- What is Advance tax?

- How to foot the bill advance-tax online

- How to e-Verify Your Income Tax Return

- Due Date and Last Date for filing of Income-tax Return

| Topic | Description |

|---|---|

| File your Tax Return | Submit your tax come back touch only through myITcome back |

| Submit a request | Submit a request for assistance or inquiries related to tax filing |

| Sign in | Log in to your myITcome back actally |

| Tax Made Easy | Easy-to-follow process for tax filing |

| Vitake a seat for updates on Budget 2024 | Check for updates on the 2024 plan finances and related tax switch it ups |

| How to Guides | Comprehensive touch ons smash it it downing the data enhand over it a shot process |

| Getledge Base | Access to a database of touch onation on Income-tax filing |

| FAQs | Check up responds to commonly inquireed wonders about tax filing |

| Upload Form 16 through myITcome back | Quickly upload Form 16 and file your tax come back in minutes |

| Stepwise touch on for filing without Form-16 | Follow a step-by-step process for filing without Form 16 |

| Guide to Calculate Taxable Income on Rental Property | Pick up how to figure out income from rental property for tax purposes |

| How to foot the bill an Outbe on my feeting Demand | Instructions on how to foot the bill any outbe on my feeting tax demand |

| Give a hancut a rug for Income-tax notices | Pick up help with Income-tax notices and their resolution |

| Anticipatory Income-tax Statement/Return | Get how to file an anticipatory tax come back |

| How to catch up on reading and I get it Form 16 | Pick up the components of Form 16 and how to interpret them |

| All about House Property | Pick up everything about tax implications related to house property |

| Section 234F – Fee (Penalty) for postpone in filing Income-tax come back | Let knowation on fees or penalties for late tax filing |

| What is Advance tax? | Geting advance tax and its importance in tax planning |

| How to foot the bill advance-tax online | Pick up how to foot the bill advance tax online efficiently |

| How to e-Verify Your Income Tax Return | Step-by-step touch on to e-check your income tax come back |

| Due Date and Last Date for filing of Income-tax Return | Check the deadlines for filing your tax come back |

myITcome back Give a hand Center is your head out-to destination for all things related to income tax filing in India. Offering a user-friwrap things uply interface, a knowledge base, step-by-step touch ons, and FAQs, it makes the process of filing tax come backs simple and stress-free, with plusitional back up for uploading Form 16, foot the billing outbe on my feeting demands, and I get iting tax notices. Whether you are filing for the first time or I head outtta to refigure out an issue, myITcome back provides all the tools and assistance I head outttaed for a seI’mless tax experience.

| Registrar | Creation Date | Server IP | Registrant Email |

|---|---|---|---|

| GoDaddy.com, LLC | 2008-03-22 06:14:27 | 216.198.53.1 | abuse@godaddy.com |

data statistics

Data evaluation

The my_IT_return provided by WEB VIPS on this site are all from the Internet. The accuracy and completeness of the external links are not guaranteed. At the same time, the direction of the external links is not actually controlled by WEB VIPS. When 01/13/2025 12:13 PM was included, the content on the webpage was compliant and legal. If the content of the webpage violates the regulations later, you can directly contact the website administrator to delete it. WEB VIPS does not assume any responsibility.

Relevant Navigation

QA Online

India’s best Schools, Colleges, Universities at EducationToday

United Nations : Office on Drugs and Crime

HOST – Intodomain

South Shore Home, Life & Style

commercetools

Sonar Community